Micro: Individual Buildings

Building owners can offer their own flexible coworking spaces, providing a better sense of control and rapid response to crisis by removing the intermediary. In our ever-evolving world of social distancing, direct control can streamline the decision-making associated with access. And in other crises, like severe weather or a natural disaster, they can offer emergency power. Building owners also have access to building-wide resources, as well as complete knowledge of temporary vacant space—both of which enable the quick adaptation of space for tenants. As resilience best practices evolve, building owners are well-positioned to implement long-term improvements (like mechanical air filtration or touchless elevator controls) that enhance the health, safety, and comfort of their occupants.

Macro: A Diversified Portfolio

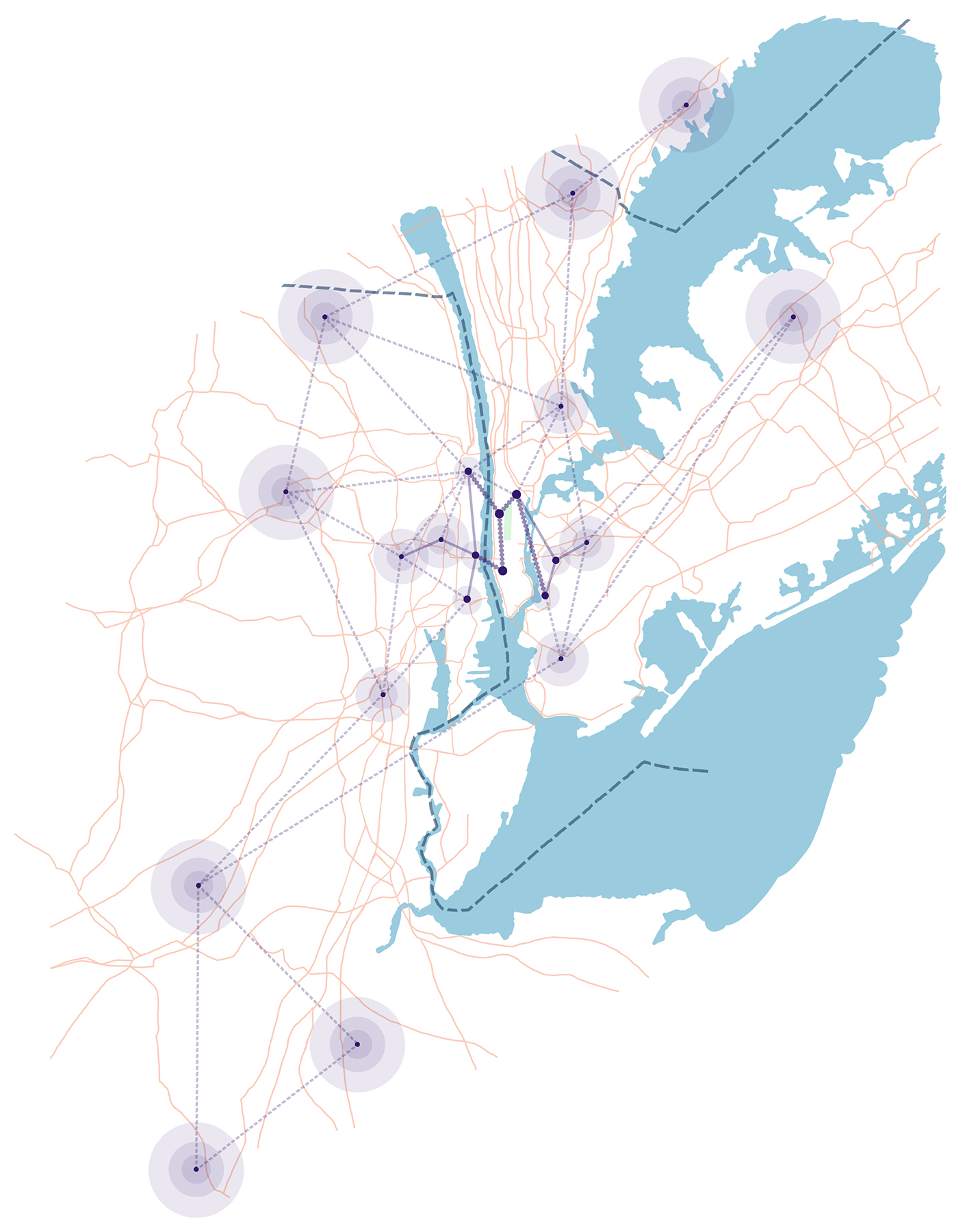

Some owners may choose to scale up the individual building approach outlined above by leveraging several of their properties for a flexible coworking network. At this scale, building owners can use a portfolio’s collective capacity to respond to any fluctuation in tenant demand. Plus, by geographically diversifying coworking offerings, building owners are inherently reducing their exposure to unforeseen, localized risks, like power outages or damage from severe weather. And, as dense urban cores are disproportionately impacted by large-scale events—from hurricanes to pandemics—leveraging the full range of a portfolio allows building owners to draw on urban fringe and first-ring suburbs to meet tenant needs.