CD: Architects and engineers have been focused on making hyper-efficient buildings to cut the carbon that is used to run a business over its lifespan. But what is of even bigger importance right now is the need to cut the up-front, or embodied, carbon that is released by the creation and transport of materials like concrete and steel—reducing the great big “burp” of carbon that is given off at the onset of a new space or building. Forty percent of global carbon emissions come from the building and construction industry: Operational carbon is 29% while embodied carbon makes up 11%. Once you burp, that carbon is out there. So carefully selecting materials, whether they come from salvaged sources, contain recycled content, or have a low embodied carbon profile, is really important.

We told Perkins&Will, who have done work for us for decades, that we wanted our new headquarters in Atlanta, Georgia to have low embodied carbon. They came to us with a very specific tactical plan where they were able to divert, recycle, or donate 93% of all the materials that would normally have been construction waste, and they specified a curtain wall and interior finishes that had low embodied carbon. We set the aspiration, but we rely on the architects and designers to activate the plan and put pressure on the contractors and suppliers, and they absolutely did.

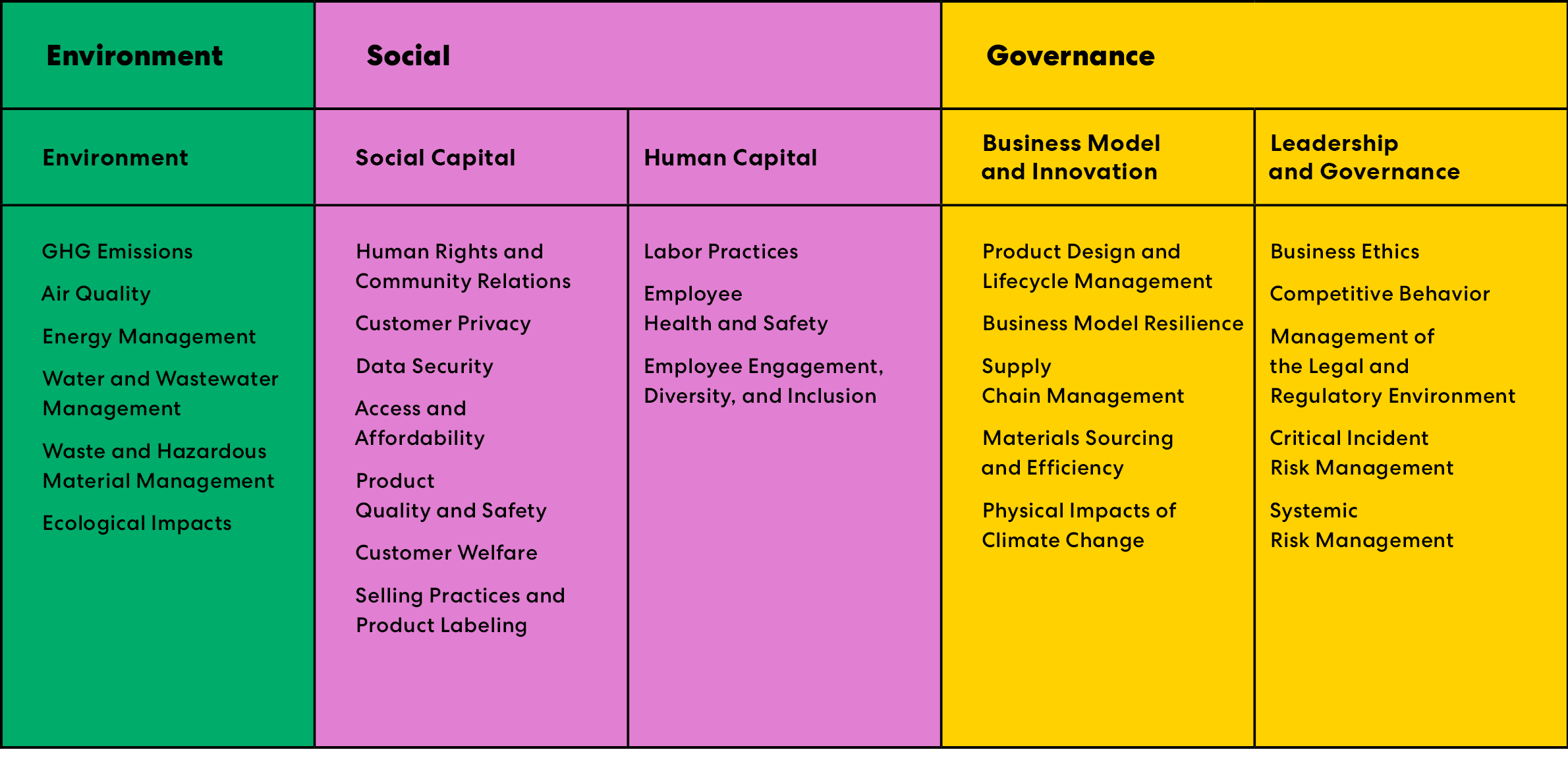

JL: In addition to the impact that architects and designers can have in the environmental space, they can also play a part in the social—or people-focused—aspect of ESG. During the pandemic, we’ve seen that the way spaces are designed can really benefit occupant health and well-being. By creating healthy workplaces, companies are showing that they’re concerned about the people they employ.