Over the years, we have developed a three-step process to help campuses not only right-size for changing circumstances, but do so in ways that reinforce unique strengths and enhance the campus experience.

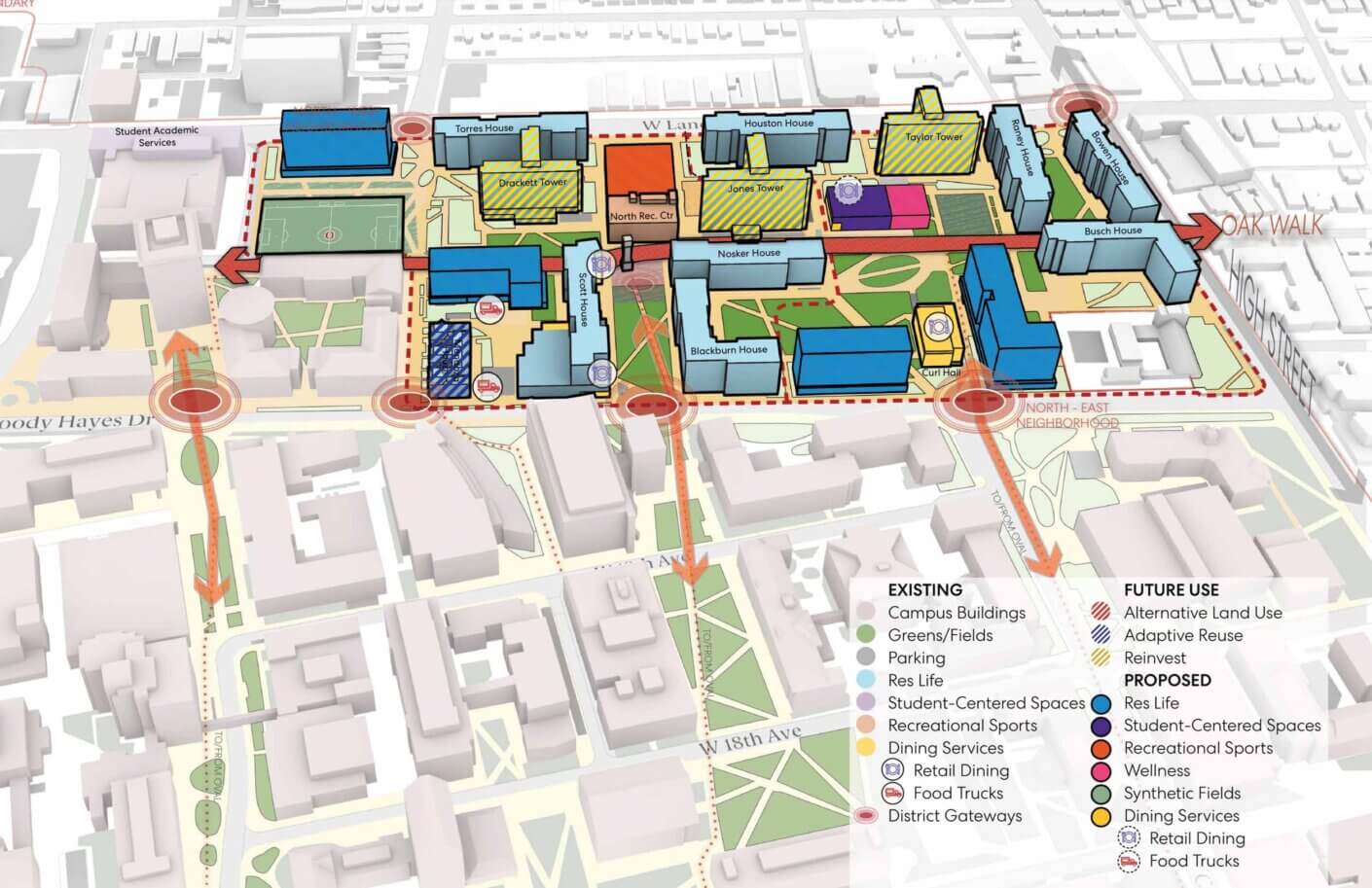

The first step is to assess and quantify space utilization and programming needs, particularly as they relate to mission alignment. Have silos created redundancies? Which assets are underutilized, and why? Which assets are exceptional? How are various spaces perceived by students? What is their impact on the student experience and overall recruitment and retention?

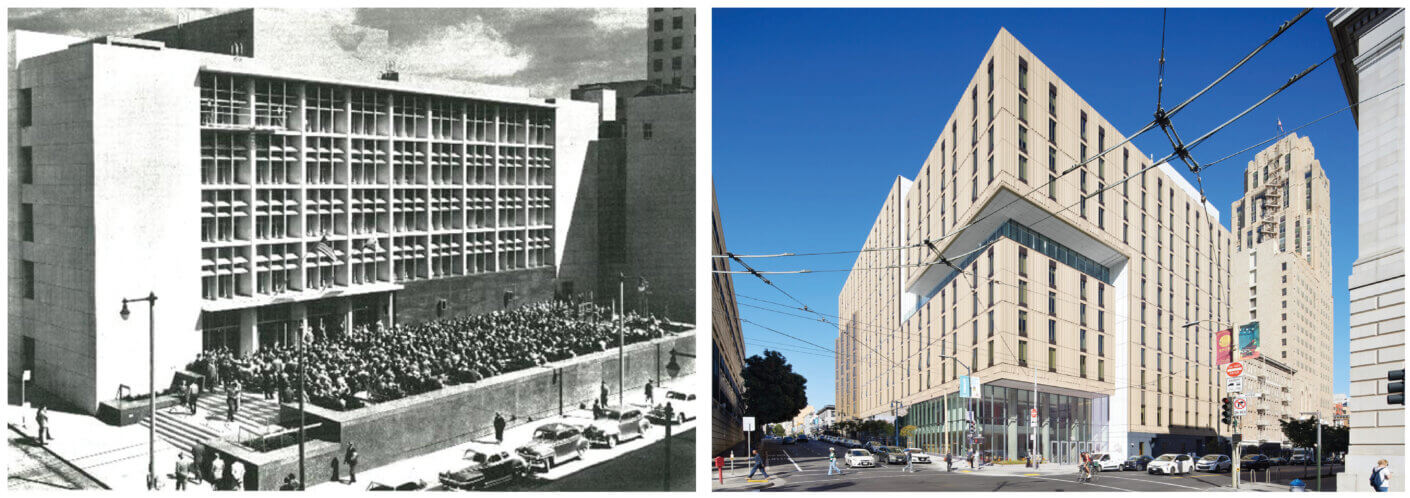

The second step involves space redistribution. The assessment phase will spark ideas about adaptive reuse and strategically reallocating space across campus into highly utilized buildings that become mixed-use in their programs. Which departments are like-minded or co-dependent? Could new synergies be sparked by sharing space? Big goals can drive a cultural shift and send a focused message to support new ways of operating.

The third step, implementation, requires bold change. Perhaps excess space could be divested to tighten up the campus footprint. Partnerships could be forged with other academic institutions, industry, developers, government agencies, alumni, or the community to assist with strategy, funding, or investment. By exploring partnership options, institutions can reduce their operational footprints and lighten their deferred maintenance burdens, thereby improving their long-term financial stability.

Throughout the process, leaders should be guided by their core values, their campuses’ context-specific goals, and their unique assets. Leaders need to be aspirational, seeking to elevate the experience for everyone on campus, while also being practical by carefully considering local market forces, the costs of ongoing maintenance, and other factors.